- One lunp sum fixed payment mortgage calculator how to#

- One lunp sum fixed payment mortgage calculator full#

- One lunp sum fixed payment mortgage calculator free#

How to do it: You can make lump sum payments by logging into EasyWeb Online Banking or by visiting a branch. With a TD mortgage that's open to prepayment, you can make as many lump sum payments as you like each year (without prepayment charges) to help shrink your principal and pay off your mortgage faster.

:max_bytes(150000):strip_icc()/GettyImages-157612066-37897f1a9ce648ad82e003fc9be5cd31.jpg)

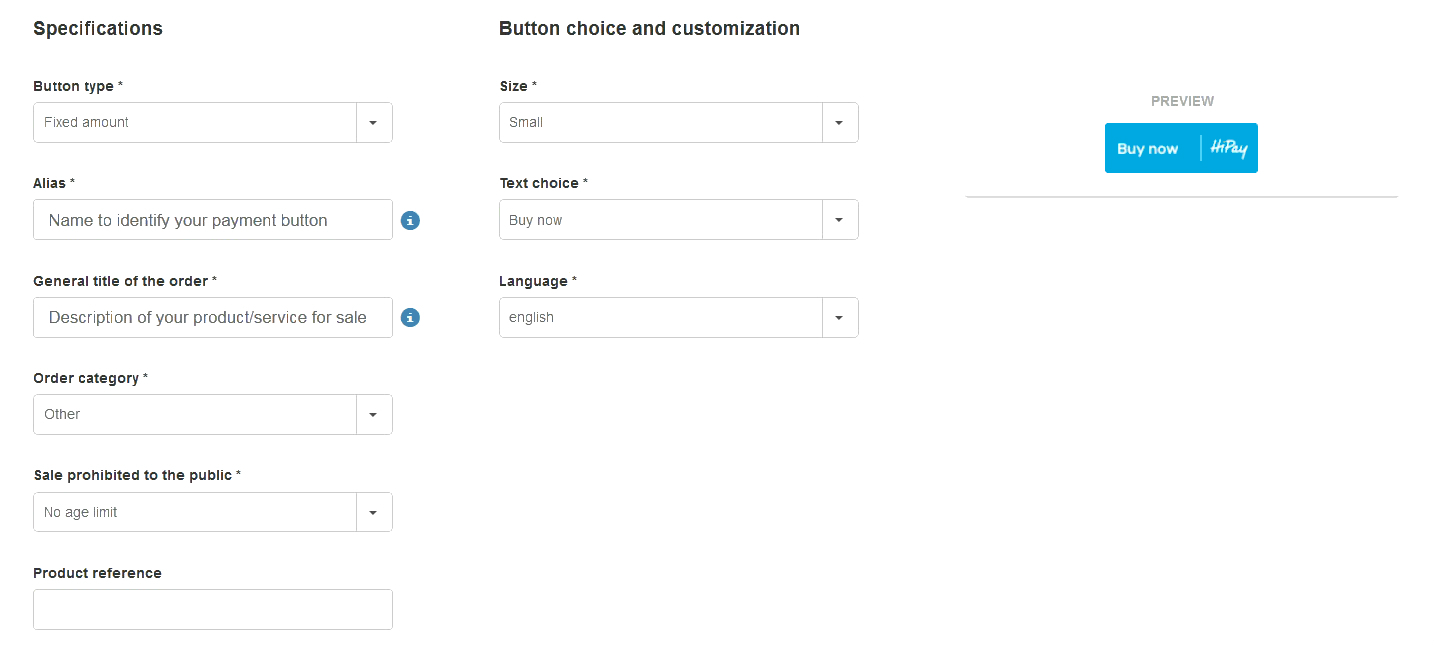

Chat with a Mortgage Specialist for more details. You may also enter extra lump sum and pre-payment amounts.

One lunp sum fixed payment mortgage calculator full#

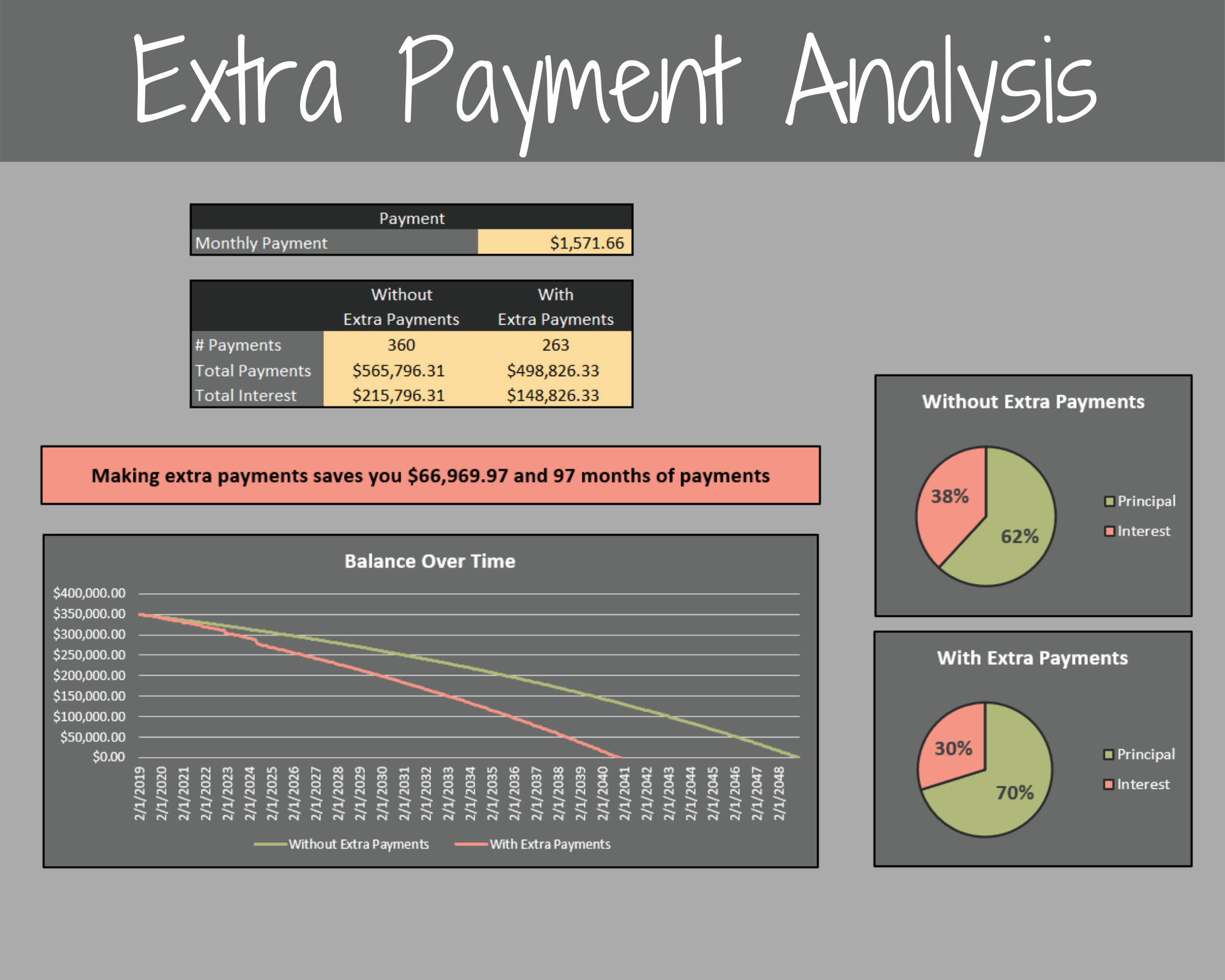

Tip: You can pay the 15% lump sum payment all at once - or over time during the calendar year. mortgage and calculates payment schedules over your full amortization. For example, if your original mortgage principal amount was $400,000, then you can make a lump sum payment of up to $60,000 every year. At TD, with a closed mortgage, you can pay up to 15% of your original amount borrowed per year without paying a prepayment charge.

There are a few things you’ll need to know about making lump sum payments.Ī lump sum payment is a one-time payment you make toward your mortgage, outside your regular payments. What it is: Say you run into some extra cash, like a tax refund, an inheritance, or a bonus at work, and you want to put it toward your mortgage. At TD, we make it easier to pay off your mortgage faster with flexible mortgage payment features. Your mortgage may come with certain prepayment privileges. Keep in mind, it’s important to understand the terms of your mortgage agreement before making any changes to your payments. There are some changes you can make at any point during your term, while others you can make when you renew your mortgage.

We’ll walk you through what you need to know to start paying off your mortgage faster.ĭuring your mortgage term, you’ll have opportunities to make changes that will help you pay off your mortgage faster. You may be looking to pay as much as you can toward the principal to reduce the amount of interest you’ll pay over the life of your mortgage. Figure1: Example of a mortgage of 300,000 with a term of. If your down payment is less than 20 of the price of your home, the longest amortization you’re allowed is 25 years. The amortization is an estimate based on the interest rate for your current term. The principal is the remaining balance of what you originally borrowed, while the interest rate is what you’re charged while that principal is outstanding. The amortization period is the length of time it takes to pay off a mortgage in full. There are two parts to each mortgage payment - the principal and the interest.

One lunp sum fixed payment mortgage calculator free#

By proceeding any further you will be deemed to have read our Terms and Conditions and Privacy Statement.Looking for ways to pay off your mortgage faster? That’s great - even small steps over time can make a big impact on helping you be mortgage free faster. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Authorised by the Prudential Regulation Authority and with deemed variation of permission. In the UK, Bank of Ireland is authorised and regulated by the Central Bank of Ireland. Bank of Ireland Group plc, whose shares are listed on the main markets of the Irish Stock Exchange plc and the London Stock Exchange plc, is the holding company of Bank of Ireland.īank of Ireland is regulated by the Central Bank of Ireland. Bank of Ireland Group plc is a public limited company incorporated in Ireland, with its registered office at 40 Mespil Road, Dublin 4 and registered number 593672.

0 kommentar(er)

0 kommentar(er)